Unlock the latest insights on price movements and trend analysis of Land Cost in diverse regions across the globe. From the bustling urban landscapes of Asia to the historic charms of Europe, the vast landscapes of North America, the vibrant cultures of Latin America, and the dynamic terrains of the Middle East & Africa, delve into the intricate dynamics shaping Land Cost prices worldwide.

Request for Real-Time Land Cost Prices: https://www.procurementresource.com/resource-center/land-cost-price-trends/pricerequest

Definition of Land Cost

Land Cost refers to the monetary value associated with acquiring or owning land. It encompasses various factors such as location, accessibility, zoning regulations, market demand, and potential usage. As an essential component of real estate economics, understanding Land Cost is paramount for developers, investors, policymakers, and stakeholders across industries.

Key Details About the Land Cost Price Trend

The land cost price trend is a reflection of the intricate interplay between supply and demand dynamics, economic growth, demographic shifts, and regulatory frameworks. Across different regions, we observe diverse patterns influencing Land Cost prices:

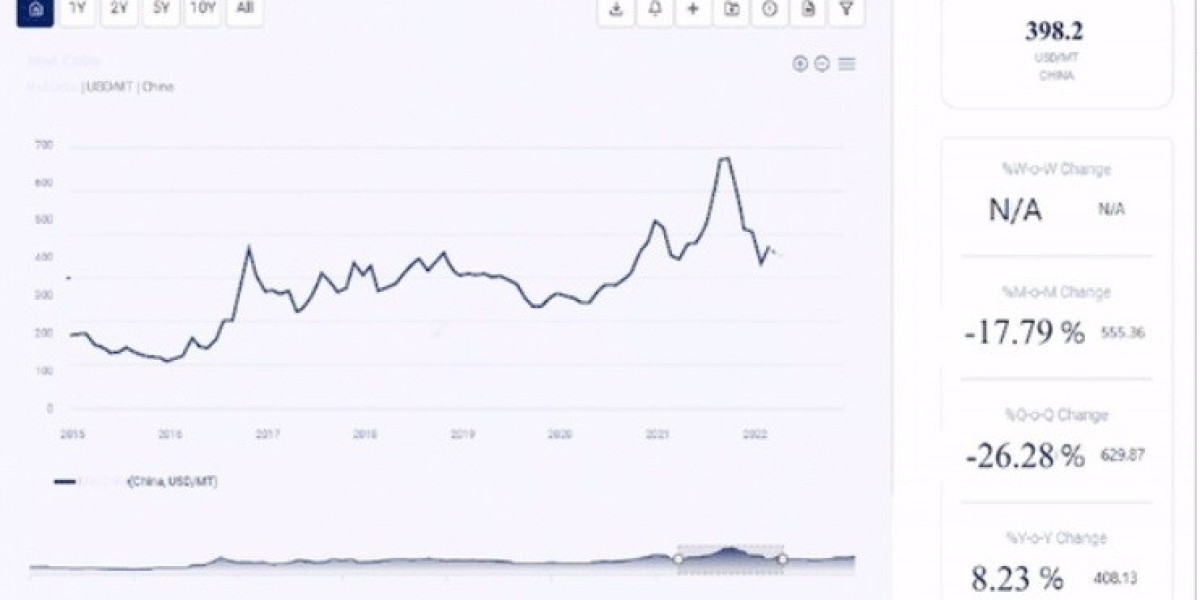

Asia: With rapid urbanization and industrialization, Land Cost prices in key Asian cities have soared, driven by robust demand for commercial, residential, and industrial spaces. Emerging economies such as China, India, and Southeast Asian nations witness dynamic fluctuations influenced by government policies, infrastructure development, and foreign investments.

Europe: In Europe, Land Cost prices vary significantly based on factors like urbanization levels, historical significance, and economic stability. Metropolitan hubs like London, Paris, and Berlin command premium prices, fueled by a confluence of cultural heritage, economic opportunities, and limited land availability.

North America: The Land Cost landscape in North America is shaped by diverse factors, including population growth, land-use regulations, and market dynamics. While urban centers like New York City and San Francisco witness skyrocketing Land Cost prices, secondary markets experience nuanced trends influenced by regional economic conditions and development prospects.

Latin America: Latin America boasts a rich tapestry of landscapes and cultures, translating into diverse Land Cost dynamics. From the bustling metropolises of Sao Paulo and Mexico City to the pristine coastlines of Costa Rica and Uruguay, Land Cost prices exhibit a blend of urbanization pressures, natural resource abundance, and investment trends.

Middle East & Africa: In the Middle East & Africa, Land Cost prices are influenced by geopolitical factors, oil wealth, urbanization rates, and infrastructure development. Rapidly evolving cities like Dubai and Riyadh witness robust Land Cost appreciation, propelled by visionary urban planning, mega-projects, and foreign investments.

Industrial Uses Impacting the Land Cost Price Trend

The industrial landscape plays a pivotal role in shaping Land Cost prices, with specific sectors exerting significant influence:

Commercial Real Estate: Demand for office spaces, retail outlets, and mixed-use developments drives Land Cost prices in prime locations, where accessibility and visibility are paramount.

Residential Housing: Population growth, urban migration, and lifestyle preferences impact Land Cost prices in residential markets, with factors like amenities, proximity to employment centers, and quality of life driving demand.

Industrial and Logistics: With the rise of e-commerce and global supply chains, industrial and logistics facilities command premium Land Cost prices in strategic locations close to transportation hubs and consumer markets.

Hospitality and Tourism: Land Cost prices in tourist destinations are influenced by factors such as natural attractions, cultural heritage, and tourism infrastructure, with demand fluctuating based on seasonal trends and geopolitical stability.

Key Players

Several key players shape the Land Cost market, including:

- Real Estate Developers: Companies specializing in land acquisition, development, and monetization strategies.

- Institutional Investors: Pension funds, sovereign wealth funds, and private equity firms actively investing in real estate assets.

- Government Agencies: Regulatory bodies, urban planning authorities, and municipal governments responsible for land-use policies and zoning regulations.

- Industry Associations: Organizations representing the interests of real estate developers, investors, and professionals, advocating for conducive business environments and best practices.

Latest News for Land Cost Market

Stay updated with the latest news and developments in the Land Cost market, including:

- Market Insights: Analysis of price movements, demand-supply dynamics, and emerging trends shaping Land Cost prices.

- Policy Updates: Legislative changes, regulatory reforms, and government initiatives impacting land acquisition, development, and utilization.

- Investment Opportunities: Opportunities for investors, developers, and stakeholders to capitalize on evolving Land Cost trends and market dynamics.

Conclusion

Procurement Resource and Land Cost are intricately linked, with Land Cost serving as a fundamental input for various industries and economic activities. By understanding the nuances of Land Cost prices, stakeholders can make informed decisions, mitigate risks, and unlock value in an ever-evolving real estate landscape.